Corporate Payout API - details

The Corporate Payout API will enable the clients to initiate payments via direct systems interface and request real-time payment information. When payment is made using this API, the client could request instant confirmation of execution once the payment has been authorized. The Corporate Payout API ensures that no payment instruction is executed without being confirmed with Signing Key.

Signing Key is a confidential personal security solution which is used with the access token to authorize signing of payments. The end-user will be able to create signing key for himself which requires SCA.

Signing Key is used to identify specific end-user and hence it should be kept safe and confidential.

Highlights of the process :

- Improved and optimized authentication flow by using Signing Key assigned to end-user.

- To enable creation of Signing Key by end-user, company agreement administrator needs to enable Personal signing key service under user’s Open Banking Services section in Corporate Netbank Administration portal.

- The expiry date of the Signing Key is configurable (from 1 min till 180 days).

- A single Signing Key can be used for multiple payments.

- No Nordea ID confirmation is required by the end-user during payment execution.

- All available payment templates are supported.

Production access to Corporate Payout

To use Corporate Payout API in production, you need an active Corporate Cash management agreement (CCM) and a Corporate Netbank Service enabled. The agreement owner needs to enable Premium APIs confirmation rights for a Corporate Netbank administrator. You can integrate Corporate Payout API via your technical ERP/TMS vendor or by developing your own system integration to Corporate Payout.

Sign up for Corporate Payout

If you have an active Corporate Cash management agreement (CCM) and a Corporate Netbank Service enabled, you can request access for Corporate Payout in production by using this registration webform. Nordea will respond to your request and guide you through the agreement set up and administrator authorisations for Premium APIs and to finalise the onboarding for Corporate Payout.

You can also add additional Premium APIs into your technical API integration, by requesting access via the same registration webform.

Changes from the previous version

This is the change log of Corporate Payout API. The topmost item is the latest version and the changes described in it are relative to the previous version which is listed directly below. The current version of the API documentation is 2.23. It is related to Corporate Payout API version 2.

Version 2.24

- In Swedish domestic credit transfer payment types ‘Within Nordea SE’ and ‘Other bank SE’ creditor name is mandatory.

Version 2.23

- Added following guidance in the beginning of this document:

- Production access to Corporate Payout

- Sign up for Corporate Payout

Version 2.22

- Changes in response text of VoP. See more from VoP in Corporate Payout API.

Version 2.21

- Changes in templates as mentioned below -

| Template | Change |

|---|---|

| SEPA_INSTANT_CREDIT_TRANSFER_FI | Template is extended to support Creditor’s Address details (Town and Country) and extend maximum length of Creditor’s Name field to 70. |

| INSTANT_CREDIT_TRANSFER_DK | Template is extended to support Creditor’s Address details (Town and Country) and extend maximum length of Creditor’s Name field to 140. |

| INTERCOMPANY_INSTANT_CREDIT_TRANSFER_DK | Template is extended to support Creditor’s Address details (Town and Country) and extend maximum length of Creditor’s Name field to 140. |

| INSTANT_SALARY_PENSION_DK | Template is extended to support Creditor’s Address details (Town and Country) and extend maximum length of Creditor’s Name field to 140. |

Version 2.20

- QRT (Nordea ID device) authentication method added for REDIRECT flow. Currently only available for Sandbox.

Version 2.19

- Verification of Payee is now included into handling of SEPA-payments in Finland. This feature is part of payment initiation endpoint. See more from chapter VoP in Corporate Payout API below.

- To test VoP in Sandbox use X-Response-Scenarios attribute in request header. See more from Corporate payout API examples section and subsection Payment initiation.

Version 2.18

- Nordea has introduced two new payment request templates for Danish instant DKK salary and pension and intercompany Danish instant DKK transfers, as shown below. The templates are currently available in sandbox.

| Template | Payment Type |

|---|---|

| INSTANT_SALARY_PENSION_DK | Initiation of instant salary or pension payments in Denmark. The debtor account is in Nordea DK and creditor account is in Nordea DK or in another Danish bank. |

| INTERCOMPANY_INSTANT_CREDIT_TRANSFER_DK | Initiation of intercompany instant credit transfers in Denmark. The debtor account is in Nordea DK and creditor account is in Denmark and registered in the same agreement as debtor account. |

- EXPRESS urgency will be decommissioned for Danish payments from 22nd of April 2024. The functionality will be available under new templates:

- INSTANT_CREDIT_TRANSFER_DK

- INSTANT_SALARY_PENSION_DK

- INTERCOMPANY_INSTANT_CREDIT_TRANSFER_DK

Version 2.17

- Nordea has introduced new payment request template for Danish Instant DKK transfers, as shown below. The template is currently available in sandbox.

| Template | Payment Type |

|---|---|

| INSTANT_CREDIT_TRANSFER_DK | Initiation of instant credit transfers in Denmark. The debtor account is in Nordea DK and creditor account is in Nordea DK or in another Danish bank. |

Version 2.16

- Added optional field “previous_key_revocation_delay” in the Signing Key creation request to set the delay for automatic revocation of the Signing Key after it expires.

Version 2.15

- Changed the maximum expiry period of the signing key from 90 days to 180 days.

Version 2.14

- Authentication type MTA_OFF removed from sandbox. It will not be available in production during May 2024 (please refer to the official communication).

- Added new filtering parameter ‘external_ids’

Version 2.13

- Added optional creditor.bank.bic field for INTERCOMPANY_DOMESTIC_PAYMENT_SE template

- Changed creditor.bank.bank_code field to optional for SDV_DOMESTIC_PAYMENT_SE and DOMESTIC_CREDIT_TRANSFER_SE templates

Version 2.12

- Change in Swedish BankID authentication method related to QR code (mentioned in section ‘BankID SE (decoupled flow)’)

Version 2.11

- Payment response model includes a new field ‘requested_execution_date’ that returns payment’s execution date

- Payment list filtering endpoint includes two new parameters: ‘execution_from_date’ and ‘execution_to_date’

Version 2.10

- Signing Key is now available in production.

- Nordea has introduced new payment request templates for Global Cash Pool transfers, as shown below. The templates are currently available in sandbox.

| Template | Payment Type |

|---|---|

| GLOBAL_CASH_POOL_TRANSFER_FI | Initiation of Global Cash Pool transfers from Finland to the Nordic countries and UK |

| GLOBAL_CASH_POOL_TRANSFER_SE | Initiation of Global Cash Pool transfers from Sweden to the Nordic countries and UK |

| GLOBAL_CASH_POOL_TRANSFER_DK | Initiation of Global Cash Pool transfers from Denmark to the Nordic countries and UK |

| GLOBAL_CASH_POOL_TRANSFER_NO | Initiation of Global Cash Pool transfers from Norway to the Nordic countries and UK |

| GLOBAL_CASH_POOL_TRANSFER_UK | Initiation of Global Cash Pool transfers from UK accounts (Nordea) to the Nordic countries and UK |

Version 2.9

- Changes in templates as mentioned below -

| Template | Change |

|---|---|

| SEPA_INSTANT_CREDIT_TRANSFER_FI | New template is added to Sandbox. Initiation of SEPA Credit Transfer Instant in Euro in the SEPA area from Finland. Creditor bank must be part of the SEPA Instant scheme. |

| INTERCOMPANY_DOMESTIC_PAYMENT_FI | Template is extended to support local cash pool and external credit accounts. |

| INTERCOMPANY_CURRENCY_TRANSFER_FI | Template is extended to support external credit accounts. |

| INTERCOMPANY_CROSS_BORDER_FI | Template is extended to support external credit accounts. |

| INTERCOMPANY_DOMESTIC_PAYMENT_DK | Template is extended to support external credit accounts. |

| INTERCOMPANY_CURRENCY_TRANSFER_DK | Template is extended to support external credit accounts. |

| INTERCOMPANY_CROSS_BORDER_DK | Template is extended to support external credit accounts. |

| INTERCOMPANY_DOMESTIC_PAYMENT_SE | Template is extended to support external credit accounts. |

| INTERCOMPANY_CURRENCY_TRANSFER_SE | Template is extended to support external credit accounts. |

| INTERCOMPANY_CROSS_BORDER_SE | Template is extended to support external credit accounts. |

| INTERCOMPANY_DOMESTIC_PAYMENT_NO | Template is extended to support external credit accounts. |

| INTERCOMPANY_CROSS_BORDER_NO | Template is extended to support external credit accounts. |

Version 2.8

- Changes in templates as mentioned below -

| Template | Change |

|---|---|

| SALARY_PENSION_DK | Template is introduced in production. |

| INTERCOMPANY_DOMESTIC_PAYMENT_FI | Template is introduced in production. |

| INTERCOMPANY_CROSS_BORDER_FI | Template is introduced in production. |

| INTERCOMPANY_CURRENCY_TRANSFER_FI | Template is introduced in production. |

| SALARY_PAYMENT_NO | Template is introduced in production. |

| INTERCOMPANY_DOMESTIC_PAYMENT_NO | Template is introduced in production. |

| INTERCOMPANY_CROSS_BORDER_NO | Template is introduced in production. |

Version 2.7

- Nordea has introduced recurring payments which will allow customers to set a recurrence for different payment types. This feature has been introduced for only Finland and available for all payments types, except Financial payment template (FINANCIAL_PAYMENT_FI). This is currently available only in Sandbox. The payment list has been modified to capture the recurring payments. New filter conditions added in the list -

- recurrence_status

- recurrence_initial_parent_payment_id

- Nordea has introduced new payment request templates, as shown below.

| Template | Change |

|---|---|

| SDV_DOMESTIC_PAYMENT_SE | Template is introduced in production. |

| SALARY_PAYMENT_NO | New template is added to Sandbox. Initiation of salary payments where the debtor and creditor accounts are in NOK. Debtor account is in Nordea Norway. Creditor account is in any bank in Norway (also in Nordea). |

| SALARY_PENSION_DK | New template is added to Sandbox. Initiation of salary or pension payments where the debtor and creditor account is in DKK and Nordea Denmark. |

Version 2.6

- Nordea has introduced new payment request template to Corporate Payments API for Sweden, as shown below.

| Template | Change |

|---|---|

| SDV_DOMESTIC_PAYMENT_SE | New template is added to Sandbox. Initiation of same day value transfer where the debit account is in Nordea SE and credit account is in other Swedish bank, other than Nordea. Both account and payment currency must be SEK. |

Version 2.5

-

A new field (additional_data.total_number_of_payments) is introduced in the payment list, which shows the total number of payments fulfilling the search criteria.

-

Nordea has introduced new payment request template to Corporate Payments API for Norway, as shown below.

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_NO | New template is added to Sandbox. Initiation of transfer where the debit account is in Nordea NO and credit account is in Nordea NO or in another Norwegian bank. Both account and payment currency must be NOK. |

| INTERCOMPANY_CROSS_BORDER_NO | New template is added to Sandbox. Initiation of a currency transfer where debtor account is in Nordea NO and the creditor account is in Nordea NO, in another Norwegian bank or any bank outside Norway. At least one of the accounts or payment amount is other than NOK. |

Version 2.4

- Nordea has introduced new payment request template to Corporate Payments API for Finland, as shown below. Currently, this is available in sandbox only.

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_FI | Initiation of transfer where the debit account is in Nordea FI and credit account is in Nordea FI or in another Finnish bank. Transfer is accepted for EUR currency only. |

| INTERCOMPANY_CROSS_BORDER_FI | Initiation of a currency transfer to any bank outside Finland. The debtor account belongs to Nordea Finland and can be in any currency. |

| INTERCOMPANY_CURRENCY_TRANSFER_FI | Initiation of a currency transfer where the debit and credit accounts are in Nordea FI. At least one of the accounts or payment amount is other than EUR. |

- Changes in templates as mentioned below -

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_DK | Template is introduced in production. |

| INTERCOMPANY_CROSS_BORDER_DK | Template is introduced in production. |

| INTERCOMPANY_CURRENCY_TRANSFER_DK | Template is introduced in production. |

Version 2.3

- Changes in templates as mentioned below -

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_SE | Template is introduced in production. |

| INTERCOMPANY_CROSS_BORDER_SE | Template is introduced in production. |

| INTERCOMPANY_CURRENCY_TRANSFER_SE | Template is introduced in production. |

- Nordea has introduced new payment request template to Corporate Payments API for Denmark, as shown below.

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_DK | New template is added to Sandbox. Initiation of transfer where the debit account is in Nordea DK and credit account is in Nordea DK or in another Danish bank. Transfer is allowed between DKK currency, with accounts in Nordea DK. For creditor account in other Danish bank, transfer is accepted only for DKK currency. |

| INTERCOMPANY_CROSS_BORDER_DK | New template is added to Sandbox. Initiation of a currency transfer to any bank outside Denmark. The debtor account belongs to Nordea Denmark and can be in any currency. |

| INTERCOMPANY_CURRENCY_TRANSFER_DK | New template is added to Sandbox. Initiation of a currency transfer where the debit and credit accounts are in Nordea DK. At least one of the accounts or payment amount is other than DKK. |

Version 2.2

- Transfers within own agreement is now enabled for all the templates.

- New optional “language” field added for requests using Swedish BankID authentication method.

- Nordea has introduced new payment request template to Corporate Payments API for Sweden, as shown below.

| Template | Change |

|---|---|

| INTERCOMPANY_DOMESTIC_PAYMENT_SE | Initiation of transfer where the debit account is in Nordea SE and credit account is in Nordea SE or in another Swedish bank. Transfer is allowed between EUR and/or SEK currency, with accounts in Nordea SE. For creditor account in other Swedish bank, transfer is accepted only for SEK currency. |

| INTERCOMPANY_CROSS_BORDER_SE | Initiation of a currency transfer to any bank outside Sweden. The debtor account in any currency is in Nordea Sweden. |

| INTERCOMPANY_CURRENCY_TRANSFER_SE | Initiation of a currency transfer where the debit and credit accounts are in Nordea SE. At least one of the accounts or payment amount is other than SEK or EUR. |

Version 2.1

- Updated “Codes App” application name to “Nordea ID”

- Added new header request for Verify endpoint during Payment Initiation (X-Response-Scenarios : paymentVerificationRequired). Currently only available for Sandbox.

- BANKID authentication added for Decoupled flow, applicable for SE. Currently only available for Sandbox.

Version 2.0

- Updated API to version 2

- Payments redirect authorization flow introduced for BankID verification in Sweden and CodesApp for all countries

- Updated paths for Signing Key and Payments endpoints

- Added Verify endpoint for Payments

Flows

Client applications must have obtained and present an access token with the “PAYMENTS_BROADBAND” scope in order to access the Payments endpoints. For more details please see: Corporate Access Authorization API.

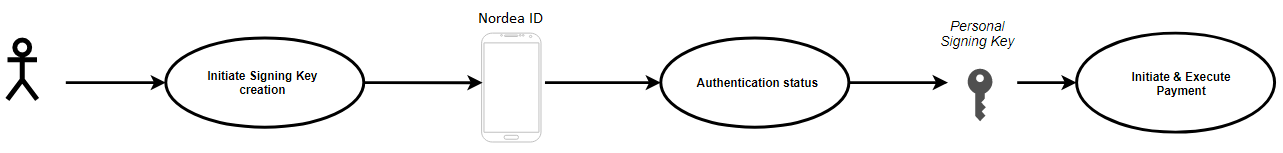

In the simplest possible case the flow might be represented diagrammatically thus:

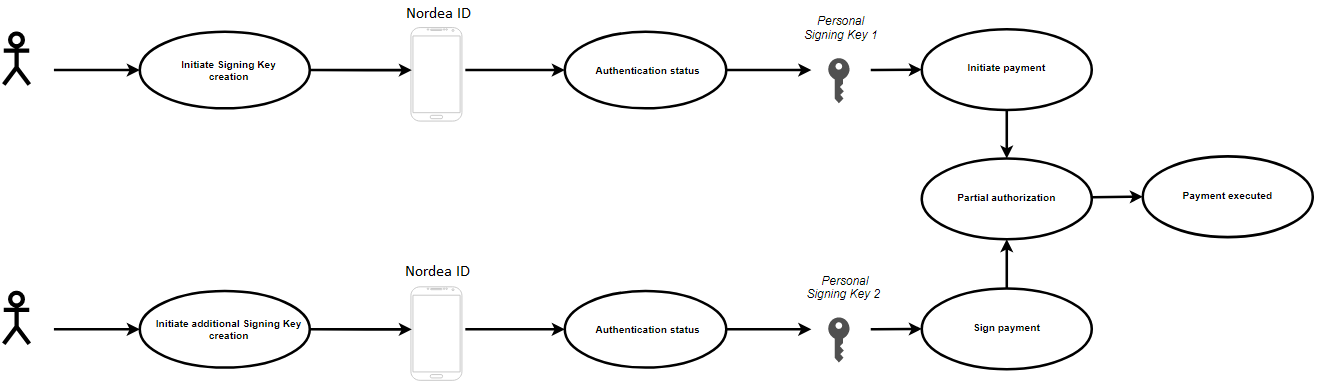

However, if authorization is required from more than one payment service user, the flow might be extended to appear thus:

Signing Key Flow

To be able to create the Signing Key, end-user needs to have enabled “Personal signing key service” under end-user’s ” Open Banking Services” section in Corporate Netbank Administration portal. Please be aware that as of now the changes done in Corporate Netbank Administration portal are imported twice per day around 6:30 AM CET and 1:30 PM CET every day. That means, if the end-user just got the “Personal signing key service” enabled, there might be a delay till the changes will be visible by Open Banking.

Initiate creation of the signing key

POST /corporate/v2/keys/sign

Request to initiate Signing Key creation, including end-user authentication (SCA) details. The request includes the Corporate Netbank logon id of the payment service end-user who is requesting the payment along with the roles and the duration for which the access will be required. End-user will be asked from strong customer authentication to confirm the Signing Key.

After sending the request, the status of the key will be “AUTHENTICATION_PENDING”, informing that end-user is expected to authenticate using selected authentication method. To check current status and value of the Signing Key please continue with Fetching details of the Signing Key

If the Signing Key authentication fails for any reason the status will change to “AUTHENTICATION_FAILED”, in such case the Signing Key can’t be processed any more and new one needs to be initiated if needed.

Even though using a Signing Key does not require additional authentication from the end-user, the Signing Key owner permissions are still evaluated for each action for which the Signing Key is being used.

To set a delay for the automatic revocation of the previous keys after new one is created, please set the value for “previous_key_revocation_delay”. Maximum values for the field is “300” seconds.

Fetching details of the Signing Key

GET /corporate/v2/keys/<key_id>

At any stage of the process the client application can obtain status of the Signing Key creation process by making a request which returns details of the Signing Key and the current state.

If the status reaches “KEY_ACTIVE”, “key” field will appear with the new Signing Key value available to use. Signing Key value has a form of an encrypted token that proves the end-user identity for the defined roles for which it can be used. Checking the details of Signing Key is a mandatory step in the process as it is the only way to get the Signing Key value.

Whenever the details of Signing Key are fetched, new “key” value will be returned, even if the same key id is used.

Whenever the end-user creates new Signing Key, all the old Signing Keys for that particular end-user are being automatically revoked. Revocation happens when the new value is returned so please ensure the mechanism of replacement of the old keys with the new ones. If the new Signing Key will have the “previous_key_revocation_delay” value set above 0, the automatic revocation will happen after the time set in the value.

Revocation of access to Signing Key

POST /corporate/v2/keys/revoke

Used for revoking the Signing Key.

When the key is revoked, it can’t no longer be used as a proof of identity. Key revocation can not be reversed, if the end-user still wants to use Signing Key after revocation, new Signing Key needs to be created.

Signing Key status

The reported state of a user’s Signing Key can be any of the following…

| Signing Key Status | Explanation |

|---|---|

| AUTHENTICATION_PENDING | Authentication of authorizer is pending. Key is not granting access to any action yet. |

| AUTHENTICATION_FAILED | Creation of the signing key finished unsuccessfully due to the failure during authentication of its authorizer. |

| KEY_ACTIVE | Signing key is active and grants access for actions specified by its roles. |

| KEY_EXPIRED | Signing key validity expires and it no longer grants any access. |

| KEY_REVOKED | Signing key access is revoked. |

Payment Flow

POST /corporate/premium/v2/payments

Request initiation of credit transfer payment from a Nordea customer’s corporate account. Request contains payment template id with all details of the payment instruction.

Sending different Payment Template Id will result with initiation of different credit transfer type. Each of requests assigned to each template id has its specific validations and fields available.

Initiation request is automatically signed using Signing Key. If the Signing Key owner have the act alone rights over the debtor account and the request is valid the payment could be automatically executed without any further actions. Since the payments are processed in the background, and it takes various time depending on the payment selected, we do not return updated payment status in the api response, instead you will always see “PAYMENT_INITIATED”. To check the current status of the payment, please use Fetching details of the Payment or Fetching list of payments features.

If the Signing Key owner have two-together rights, the payment should change its status to “AUTHORIZATION_PARTIAL” and will require second signing using another user’s Signing Key.

Nordea will verify payees for all SEPA payments in Finland. This verification of payee (VoP) happens during payment initiation request, and the result is returned as a part of payment initiation API response. Depending on the result of Verification of Payee, separate payment signing might be needed. See more from section Signing a Payment and from VoP in Corporate Payout API.

The payment can be also suspended, for example due to security reasons, then the payment will require an additional verification through strong customer authentication. Those cases can be identified by two fields in the response: “payment_status” with value “AUTHORIZATION_PARTIAL” and “payment_status_reason” with value “info.payment.verification_required”. In such case, please follow the Verify a Payment scenario.

If the error occurs during payment initiation, the payment can change the status to “PAYMENT_REJECTED”, in such case the payment can’t be processed anymore and new one needs to be initiated if needed.

PATCH /corporate/premium/v2/payments/<payment_id>/sign

Before payment can be executed, separate authorization/signing might be needed for several reasons. For example, some customers demand that payments will be confirmed together or confirmed in two groups. This depends on chosen set-up in CN. Corporate Payout API will do Verification of Payee in payment initiation phase for all Sepa-payments in Finland. If VoP-response was something else than “MATCH” then payment must be signed separately before payment will be executed. See more from VoP in Corporate Payout API-section. In those cases, payment will be in “AUTHORIZATION_PARTIAL” status after payment initiation, and client must separately sign a payment, before payment processing will continue.

If the signing fails for any reason, the status will change to “AUTHORIZATION_FAILED”. The reason for failure should be found and resolved, then the signing request can be sent again with same or different Signing Key.

If payment is in “AUTHORIZATION_PARTIAL” status but the “payment_status_reason” is “info.payment.verification_required” than the given payment can’t be signed, it needs verification instead.

All payments apart from SEPA_INSTANT_CREDIT_TRANSFER_FI needs to be confirmed before the end of its requested execution date, or they will be rejected.

POST /corporate/premium/v2/payments/sign

Should further authorization be required before the payment can be executed (See more above from chapter Signing a Payment), then payment status records a state of AUTHORIZATION_PARTIAL, inviting the client to nominate an additional authorizer to provide Signing Key and advance the payment authorization process. The request accepts the list of payment ids which must contain the payment ids originally returned from the initiation of a credit transfer payment. All payments will be signed with single Signing Key. Upon success, status of each payment object will be updated to AUTHORIZATION_PENDING. Current maximum number of the payments that can be confirmed at once is 20.

If payment is in “AUTHORIZATION_PARTIAL” status but the “payment_status_reason” is “info.payment.verification_required” than the given payment can’t be signed, it needs verification instead.

All payments apart from SEPA_INSTANT_CREDIT_TRANSFER_FI needs to be confirmed before the end of its requested execution date, or they will be rejected.

POST /corporate/premium/v2/payments/<payment_id>/verify

Request to perform additional payment verification for the payments with status reason - info.payment.verification_required. This action requires strong customer authentication therefore the Signing Key can’t be used for this action.

Payment additional verification is the exceptional flow when the payment is suspended due to security reasons. It can be identified by “payment_status” with value “AUTHORIZATION_PARTIAL” and “payment_status_reason” with value “info.payment.verification_required”. The user verifying the payment don’t need to be the same as the one initiating the payment, only the access to view the payments from the debtor account are required.

Since the payment suspension also may block any ongoing signing of the payment, the auto-signing process that is part of payment initiation flow, might be stopped. In such scenario, when payment will be successfully verified, to continue payment execution, user that initially initiated the payment, will be required to repeat the signing using Signing a Payment. After that step, the payment should follow the normal flow.

If the additional verification fails for any reason, the status will change to “AUTHORIZATION_FAILED”. The reason for failure should be found and resolved, then the verification request can be sent again for the same or different user.

Fetching details of the Payment

GET /corporate/premium/v2/payments/<payment_id>

Request details and status of the payment instruction. The “payment_id” in the request must be the payment id (_id) originally returned from the initiated payment. The response delivers the current status and all details of the payment instruction.

GET /corporate/premium/v2/payments

Request list of the payment instructions with details and status. The response delivers the current status and all details of the payment instructions matching the search criteria. The response is paginated with the maximum number of payment instructions per page is 20.

PATCH /corporate/premium/v2/payments/<payment_id>

Request to authorize the payment cancellation instruction. Request should be sent together with the Signing Key of the request authorizer. The “payment_id” in the request must be the payment id (_id) originally returned from the initiation of a credit transfer payment. Upon success, the status of the payment object will be updated to “AUTHORIZATION_PENDING” together with the status reason “info.payment.cancellation_in_progress”.

Cancelled payments will be still available to see but their “payment_status” will be visible as “PAYMENT_CANCELLED” which is the final status, therefore those payments cannot be changed anymore. Not all statuses can be cancelled, for example, payments with status “PAYMENT_REJECTED”, “AUTHORIZATION_PENDING” or “PAYMENT_EXECUTED” cannot be cancelled.

POST /corporate/premium/v2/payments/cancel

Request to authorize the payment cancellation instructions. Request should be sent together with the Signing Key of the request authorizer. The request accepts the list of payment ids which must contain the payment ids originally returned from the initiation of a credit transfer payment. All payments will be cancelled with single Signing Key. Upon success, the status of each payment object will be updated to “AUTHORIZATION_PENDING” together with the status reason “info.payment.cancellation_in_progress”. Current maximum number of the payments that can be confirmed at once is 20.

Cancelled payments will be still available to see but their “payment_status” will be visible as “PAYMENT_CANCELLED” which is the final status, therefore those payments cannot be changed anymore. Not all statuses can be cancelled, for example, payments with status “PAYMENT_REJECTED”, “AUTHORIZATION_PENDING” or “PAYMENT_EXECUTED” cannot be cancelled.

Payment templates

The following templates are available when requesting initiation of a credit transfer.

| Template id | Description of the payment | Available in Sandbox | Available in production |

|---|---|---|---|

| DENMARK | |||

| Domestic templates | |||

| DOMESTIC_CREDIT_TRANSFER_DK | Initiation of Danish Domestic Bank Transfer in DKK. | Yes | Yes |

| DOMESTIC_TRANSFER_FORM_WITH_OCR_DK | Initiation of Danish Transfer Form with reference in DKK. | Yes | Yes |

| DOMESTIC_TRANSFER_FORM_DK | Initiation of Danish Transfer Form without reference in DKK. | Yes | Yes |

| SALARY_PENSION_DK | Initiation of salary or pension payments where the debtor and creditor account is in DKK and Nordea Denmark. | Yes | Yes |

| INSTANT_CREDIT_TRANSFER_DK | Initiation of instant credit transfers in Denmark. The debtor account is in Nordea DK and creditor account is in Nordea DK or in another Danish bank. | Yes | No |

| INSTANT_SALARY_PENSION_DK | Initiation of instant salary or pension payments in Denmark. The debtor account is in Nordea DK and creditor account is in Nordea DK or in another Danish bank. | Yes | No |

| Cross currency templates | |||

| CROSS_BORDER_DK | Initiation of a currency transfer where the debtor account in any currency is in Nordea Denmark. Creditor account can be in any currency and in any bank. Template also covers SEPA Credit Transfers from Denmark to the banks in SEPA area. | Yes | Yes |

| CURRENCY_TRANSFER_NORDEA_DK | Initiation of a currency transfer where both accounts are in Nordea Denmark. At least one of the accounts or payment amount is other than DKK. | Yes | Yes |

| FINANCIAL_PAYMENT_DK | Initiation of a currency transfer to any bank where the debtor account is in any currency, in Nordea Denmark. Creditor account is in another bank. Either the creditor or the debtor is a financial institution. | Yes | Yes |

| Intercompany templates | |||

| INTERCOMPANY_DOMESTIC_PAYMENT_DK | Initiation of transfer where the debit account is in Nordea DK and credit account is in Nordea DK or in another Danish bank. Transfer is allowed between DKK currency, with accounts in Nordea DK. For creditor account in other Danish bank, transfer is accepted only for DKK currency. | Yes | Yes |

| INTERCOMPANY_CROSS_BORDER_DK | Initiation of a currency transfer to any bank outside Denmark. The debtor account belongs to Nordea Denmark and can be in any currency. | Yes | Yes |

| INTERCOMPANY_CURRENCY_TRANSFER_DK | Initiation of a currency transfer where the debit and credit accounts are in Nordea DK. At least one of the accounts or payment amount is other than DKK. | Yes | Yes |

| INTERCOMPANY_INSTANT_CREDIT_TRANSFER_DK | Initiation of intercompany instant credit transfers in Denmark. The debtor account is in Nordea DK and creditor account is in Denmark and registered in the same agreement as debtor account. | Yes | No |

| Global Cash Pool transfer template | |||

| GLOBAL_CASH_POOL_TRANSFER_DK | Initiation of a global cash pool transfer in Nordea between transaction accounts in the same cash pool structure. The accounts need to be in the same currency. This template covers both domestic and cross-border. | Yes | Yes |

| FINLAND | |||

| Domestic templates | |||

| SEPA_CREDIT_TRANSFER_FI | Initiation of Finnish SEPA Credit Transfer in EUR. The creditor account can be in any bank in SEPA area. | Yes | Yes |

| SEPA_INSTANT_CREDIT_TRANSFER_FI | Initiation of SEPA Credit Transfer Instant in Euro in the SEPA area from Finland. Creditor bank must be part of the SEPA Instant scheme. | Yes | Yes |

| Cross currency templates | |||

| CROSS_BORDER_FI | Initiation of a currency transfer to any bank outside Finland. The debtor account belongs to Nordea Finland and can be in any currency. | Yes | Yes |

| FINANCIAL_PAYMENT_FI | Initiation of a currency transfer to any bank where the debtor account is in any currency, in Nordea Finland. Creditor account is in another bank. Either the creditor or the debtor is a financial institution. | Yes | Yes |

| CURRENCY_TRANSFER_NORDEA_FI | Initiation of a currency transfer where both accounts are in Nordea Finland. At least one of the accounts or payment amount is other than EUR. | Yes | Yes |

| Intercompany templates | |||

| INTERCOMPANY_DOMESTIC_PAYMENT_FI | Initiation of transfer where the debit account is in Nordea FI and credit account is in Nordea FI or in another Finnish bank. Transfer is accepted for EUR currency only. | Yes | Yes |

| INTERCOMPANY_CROSS_BORDER_FI | Initiation of a currency transfer to any bank outside Finland. The debtor account belongs to Nordea Finland and can be in any currency. | Yes | Yes |

| INTERCOMPANY_CURRENCY_TRANSFER_FI | Initiation of a currency transfer where the debit and credit accounts are in Nordea FI. At least one of the accounts or payment amount is other than EUR. | Yes | Yes |

| Global Cash Pool transfer template | |||

| GLOBAL_CASH_POOL_TRANSFER_FI | Initiation of a global cash pool transfer in Nordea between transaction accounts in the same cash pool structure. The accounts need to be in the same currency. This template covers both domestic and cross-border. | Yes | Yes |

| NORWAY | |||

| Domestic templates | |||

| DOMESTIC_CREDIT_TRANSFER_NO | Initiation of Norwegian Domestic Payment in NOK. | Yes | Yes |

| DOMESTIC_KID_TRANSFER_NO | Initiation of Norwegian KID Payment in NOK. | Yes | Yes |

| SALARY_PAYMENT_NO | Initiation of salary payments where the debtor and creditor accounts are in NOK. Debtor account is in Nordea Norway. Creditor account is in any bank in Norway (also in Nordea). | Yes | Yes |

| Cross currency templates | |||

| CROSS_BORDER_NO | Initiation of a currency transfer where debtor account is in Nordea NO and the creditor account is in Nordea NO, in another Norwegian bank or any bank outside Norway. At least one of the accounts or payment amount is other than NOK. This template should also be used for SEPA Credit Transfers in Euro to the banks in SEPA area and express-payment. | Yes | Yes |

| FINANCIAL_PAYMENT_NO | Initiation of a currency transfer to any bank where the debtor account in any currency is in Nordea Norway. Creditor account can be in any currency and in any bank. Either the creditor or the debtor is a financial institution. | Yes | Yes |

| Intercompany templates | |||

| INTERCOMPANY_DOMESTIC_PAYMENT_NO | Initiation of transfer where the debit account is in Nordea NO and credit account is in Nordea NO or in another Norwegian bank. Both account and payment currency must be NOK. | Yes | Yes |

| INTERCOMPANY_CROSS_BORDER_NO | Initiation of a currency transfer where debtor account is in Nordea NO and the creditor account is in Nordea NO, in another Norwegian bank or any bank outside Norway. At least one of the accounts or payment amount is other than NOK. | Yes | Yes |

| Global Cash Pool transfer template | |||

| GLOBAL_CASH_POOL_TRANSFER_NO | Initiation of a global cash pool transfer in Nordea between transaction accounts in the same cash pool structure. The accounts need to be in the same currency. This template covers both domestic and cross-border. | Yes | Yes |

| SWEDEN | |||

| Domestic templates | |||

| DOMESTIC_CREDIT_TRANSFER_SE | Initiation of Swedish Domestic Bank Transfer in SEK. | Yes | Yes |

| SDV_DOMESTIC_PAYMENT_SE | Initiation of transfer where the debtor account is in Nordea Sweden. Creditor account is in any other bank in Sweden, other than Nordea. Both account and payment currency must be SEK. Payment urgency is always same-day-value (SDV). | Yes | Yes |

| Cross currency templates | |||

| CROSS_BORDER_SE | Initiation of a currency transfer to any bank outside Sweden. The debtor account in any currency is in Nordea Sweden. Template also covers SEPA Credit Transfers from Sweden to the banks in SEPA area. Please note that for payments above 150,000 SEK, field regulatory_reporting.purpose_code is required in Sweden. | Yes | Yes |

| CURRENCY_TRANSFER_SE | Initiation of a transfer where debtor account is in Nordea SE and creditor account is in Nordea SE or in another Swedish bank. At least one of the accounts or payment amount is other than SEK. | Yes | Yes |

| FINANCIAL_PAYMENT_SE | Initiation of a currency transfer to any bank where the debtor account is in any currency, in Nordea Sweden. Creditor account is in another bank. Either the creditor or the debtor is a financial institution. | Yes | Yes |

| Intercompany templates | |||

| INTERCOMPANY_DOMESTIC_PAYMENT_SE | Initiation of transfer where the debit account is in Nordea SE and credit account is in Nordea SE or in another Swedish bank. Transfer is allowed between EUR and/or SEK currency, with accounts in Nordea SE. For creditor account in other Swedish bank, transfer is accepted only for SEK currency. | Yes | Yes |

| INTERCOMPANY_CROSS_BORDER_SE | Initiation of a currency transfer to any bank outside Sweden. The debtor account belongs to Nordea Sweden and can be in any currency. | Yes | Yes |

| INTERCOMPANY_CURRENCY_TRANSFER_SE | Initiation of a currency transfer where the debit and credit accounts are in Nordea SE. At least one of the accounts or payment amount is other than SEK or EUR. | Yes | Yes |

| Global Cash Pool transfer template | |||

| GLOBAL_CASH_POOL_TRANSFER_SE | Initiation of a global cash pool transfer in Nordea between transaction accounts in the same cash pool structure. The accounts need to be in the same currency. This template covers both domestic and cross-border. | Yes | Yes |

| INTERNATIONAL | |||

| Global Cash Pool transfer template | |||

| GLOBAL_CASH_POOL_TRANSFER_UK | Initiation of a global cash pool transfer in Nordea between transaction accounts in the same cash pool structure. The accounts need to be in the same currency. This template covers both domestic and cross-border. | Yes | No |

Intercompany templates - Used for payments between companies belonging to the same group, to move funds between companies’ own accounts within the Nordea Group (domestic and cross-border) or outside the Nordea Group if the accounts are included in the Corporate Netbank agreement. The funds will be available on the same day, if payments are within Nordea. For payments outside the Nordea Group, Nordea can never guarantee that the funds will be available on the same day in the beneficiary account.

Future dated payments - The user should use the field ‘requested_execution_date’ with future-date in the Payment Initiation request.

Recurring payments - This feature is currently available only in Finland. Customers will be able to set a recurrence for the payment. The frequency options are weekly or monthly, and the payment can be repeated continuously or until a certain date. This feature is currently available for all the payments types available in Finland, except for Financial payment template (FINANCIAL_PAYMENT_FI).

NemKonto payments - This feature is currently available only in Denmark for DOMESTIC_CREDIT_TRANSFER_DK and SALARY_PENSION_DK. The product can be compared to a regular account-to-account payment, where the credit account number is replaced by a CPR/CVR/SE number. The customer can make these payments with URGENCY_NORMAL or URGENCY_SAMEDAY. The customer should have a NemKonto payment agreement.

Payment status

The reported state of a client’s payment instruction can be any of the following…

| Payment Status | Explanation |

|---|---|

| AUTHORIZATION_PENDING | The payment authorization process is in progress. |

| AUTHORIZATION_PARTIAL | Payment instruction is only partially authorized and one or more further users are required to sign a payment to complete authorization process. |

| AUTHORIZATION_FAILED | The last nominated user failed to authorize the payment. Either they failed to authenticate or do not have authorization rights on the specified debtor account. |

| PAYMENT_INITIATED | The payment request has been accepted and will be processed soon. |

| PAYMENT_ACCEPTED | The payment instruction has been fully authorized and passed to Nordea’s payments engine for processing as per the payment scheme rules. |

| PAYMENT_EXECUTED | Payment has been executed and booked on the remitter’s account. The timing of clearing on the creditor’s account will be dependent on payment scheme and processing by the creditor’s bank. |

| PAYMENT_REJECTED | Payment instruction has been rejected. Reason is provided within the payment_status_reason code in response. |

| PAYMENT_CANCELLED | Payment instruction has been cancelled. |

| NOT_FOUND | Payment id was not found. Only applicable for signing and cancellation of multiple payments. |

Real-world cases where a payment might be rejected because for example the creditor account is unreachable or the debtor account has insufficient funds are not modeled in the sandbox environment.

Cut-off times

The cut-off time is the latest time when Nordea accepts and effects payment orders to and from customers. The cut-off time varies depending on country, payment type and currency involved.

If you want the payment to be executed within the same day, please remember to finally confirm it before its cut-off time. To check the cut-off times for specific payment types and countries, please visit https://www.nordea.com/en/our-services/cash-management/cut-off-times

VoP in Corporate Payout API

Verification of Payee (VoP) is part of the new Instant Payment Regulation (IPR) and it concern all SEPA payments where currency is EUR and debit account is in Nordea Finland. European Payments Council’s (EPC) description can be found here: https://www.europeanpaymentscouncil.eu/what-we-do/other-schemes/verification-payee. And VoP-rulebook can be found here: https://www.europeanpaymentscouncil.eu/document-library/rulebooks/verification-payee-scheme-rulebook. Verification of Payee is included as part of payment Initiation for for all SEPA payments in scope (see above). If VoP-request result is “MATCH” then payment processing will continue normally. If VoP-request result is something else than “MATCH”, payment must be signed separately before payment processing will continue. If customer will sign such payment, the bank will not be liable if the payment is made to an account not held by the named creditor. Here in underlying table is possible VoP-request result and explanation.

| VoP-result | Description | Text returned in response | Next Action |

|---|---|---|---|

| MATCH | Creditor name and account matched. | No separate text returned. | Payment will be processed as defined. No separate action needed from users. |

| CLOSE_MATCH | There is a small deviation in the name of the creditor. For example, couple of letters have changed places. | Recipient name partially differs from the account holder name. Check the recipient information. | We return in this case also matched creditor name. Customer must separately sign a payment, and that way accept VoP-result. Otherwise, payment will not be executed. |

| NO_MATCH | Name does not match. | Recipient name is not the same as the account holder name. Check the recipient information. Confirming the payment may lead to transferring funds to an account not held by the recipient you indicated. In that case, the bank is not liable for the loss of funds. If you are in doubt, don’t confirm the payment. | The creditor name in payment is not the same as the one on the account of the person or organization you want to pay. We strongly recommend that customer confirm the correct name directly with the creditor before continuing. If you send funds to the wrong account, you may not get the money back. |

| NOT_AVAILABLE | Verification not possible. For technical reasons the check cannot be performed. | We could not compare recipient name with account holder name. | Customer must separately sign a payment, and that way accept VoP-result. Otherwise, payment will not be executed. If customer choose to authorize a payment, the bank will not be liable if the payment is made to an account not held by the named creditor. |

See also examples below.

Authentication Flow

Authentication Types

| Authentication Type | Description | Available in Sandbox | Available in production |

|---|---|---|---|

| REDIRECT | Initiation of redirect OAuth flow where Corporate Netbank user requesting the authorization will be able to confirm the instruction using one of supported authentication methods via Nordea page. | Yes | Yes |

| Authentication Methods: | |||

| - BANKID_SE | Authentication using BankID. Only available for Swedish users. | Yes | Yes |

| - MTA | Authentication using Nordea ID mobile application. Available for all Corporate Netbank users. | Yes | Yes |

| - QRT | Authentication using Nordea ID device. Available for all Corporate Netbank users. | Yes | No |

| DECOUPLED | Immediate initiation of authentication session on Corporate Netbank user device. User will be able to confirm the instruction by selected authentication method. | Yes | Yes |

| Authentication Methods: | |||

| - MTA | Authentication using Nordea ID mobile application. Available for all Corporate Netbank users. | Yes | Yes |

| - BANKID_SE | Authentication using BankID. Only available for Swedish users. | Yes | Yes |

Whilst operating the Payments API in our sandbox environment authentication types behavior is adjusted.

When using REDIRECT authentication type, execution of redirect link will automatically progress to the next stage in the authorization process. Ordinarily in real-world use, at this point the user would be redirected to Nordea page where they would be invited to securely authenticate themselves.

Get BankId Se authentication details (Decoupled Flow)

GET /corporate/premium/v1/authentications/bankid_se/{authentication_id}

When “authentication_type” = “DECOUPLED” and “authentication_method” = “BANKID_SE” values are selected, in the response “authentication_id” field is provided. Authentication ID is to be used in the below endpoint.

In the response, when applicable, qr_data and auto_start_token values are returned. Qr_data is converted to QR code and scanned by end user BankId SE mobile application.

If, BankId application on customer mobile application needs to be used directly, “auto_start_token” has to be used.

As long as the status is WAITING_FOR_USER, new qr_data is generated in small intervals, so it’s advised to poll for the endpoint approximately every second until SUCCESS or FAILED status appears. Access token is not required to use authentications endpoints. Please see the examples section for better understanding.

The status will give the state of signing as below.

| Status | Description |

|---|---|

| WAITING_FOR_USER | Awaiting end user signing assignment. |

| IN_PROGRESS | End user signing process is in progress. |

| SUCCESS | Signing process has completed successfully. |

| FAILED | Signing was not completed by end user and needs to be started again. |

Changes in the scope will impact the current behavior of signing key and verify endpoints.

Corporate payout API examples

Here you can find examples how to use the Corporate Payout API endpoints.

Initiate creation of a Signing Key

This endpoint URL has the following form:

POST /corporate/v2/keys/signThis endpoint supports POST HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Digest: {digest}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}SANDBOX ONLY

When using REDIRECT authentication_type please add: X-Nordea-Mock-Authorizer-Id: {authorizer_id}

The body of the request will vary, determined by the authentication type chosen.

Example of DECOUPLED authentication type with MTA authentication method

{

"key_details": {

"roles": [

"SIGNING_PAYMENTS",

"CANCELLING_PAYMENTS"

],

"duration": 129600

},

"authorization_details": {

"authentication_type": "DECOUPLED",

"authentication_method": "MTA",

"authorizer_id": "70311198"

}

}

Example of DECOUPLED authentication type with BANKID_SE authentication method

{

"key_details": {

"roles": [

"SIGNING_PAYMENTS",

"CANCELLING_PAYMENTS"

],

"duration": 129600

},

"authorization_details": {

"authentication_type": "DECOUPLED",

"authentication_method": " BANKID_SE "

}

}

Example of REDIRECT authentication type

{

"key_details": {

"roles": [

"SIGNING_PAYMENTS",

"CANCELLING_PAYMENTS"

],

"duration": 129600

},

"authorization_details": {

"authentication_type": "REDIRECT",

"redirect_uri": "https://test.com",

"state": "state",

"authentication_method": "BANKID_SE",

"language": "en"

},

"previous_key_revocation_delay": 300

}Where the request is valid the response will be 201 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "IVnmYM1Sii_MMXFk",

"creation_date_time": "2021-03-26T07:02:58.3069241Z",

"http_code": 201

},

"response": {

"key_id": "6cee4b05-2cb3-4e52-96f4-8f5b2ed8839a",

"status": "AUTHENTICATION_PENDING",

"roles": [

"SIGNING_PAYMENTS",

"CANCELLING_PAYMENTS"

],

"duration": 129600,

"auto_start_token": "8441d326-2d6e-4e4f-9412-303ec3d0931c",

"authentication_id": "4c5d6d5cb844160bc28325b1160ca6ca31324822ffd136266c447370d0656ff8",

"_links": [

{

"rel": "self",

"href": "/v2/keys/sign"

},

{

"rel": "details",

"href": "/v2/keys/6cee4b05-2cb3-4e52-96f4-8f5b2ed8839a"

},

{

"rel": "revoke",

"href": "/v2/keys/revoke"

},

{

"rel": "redirect",

"href": "https://api.nordeaopenbanking.com/corporate/payments/identify?client_id=Psf34PDHxdLy2Sfyr4UF&code_challenge_method=S256&redirect_uri=https%3A%2F%2Fapi.nordeaopenbanking.com%2Fcorporate%2Fpayments%2Foauth&response_type=code&code_challenge=HAULnO8Z7njZCem7zHPq0FzSQxW5Sc2Im2WWEsVwlEU&scope=openid+agreement&state=80dff5c3-a1f9-499a-8bad-bf886801e0b9&nonce=PhSHQiuWOwCbRTGS9N5SrlRA2kSDyjK3DUGw71ly&login_hint=bankid_se&signing_token=eyJjdHkiOiJKV1QiLCJlbmMiOiJBMjU2R0NNIiwiYWxnIjoiUlNBLU9BRVAtMjU2In0.hMT3ZHEcf3TNpnCrYfiisvB08y9C0AtezO9QuGqtR0L0OeLt8HWYN0v3PU8ZF1iu_v_Rh5LA4CjoIOU8lCGLSFmddUEfhl9iqMUeSh5wLizZv4pF6bo_YRnmR9WqLMzZpq_-dB9MB7mMA2KVHX6Jmy3ZWrleFuUabGdgypdyKy1Bi9tFAYFE0tHEAwm_8vPVyppypT6VFaldvRO8kTJrqZVuTFIYLXDKV69D8b40mEkcTRC5CO029UgCyyV8-Ia3vdhjk_0QklszkrAU0KlvIzVYat4GbXzbTC-snHJ_qgutFygtNH2vM1a84rLaYszbRa6dT285WsyCuNjMIHwSnQ.Dn2xpMne03d9EKzd.Sy83KdbkCzsXaSrUASZdWyRGKZ61jErjQLhN31j6ty7R7z81DGcdWUrB9X4DnHmWq2ZbzE2QI7xc3lAAllClrDyB90ZRPK62yLDprU0CHvIGIuLtC-ORqI5NhNtVS1XWkgHT_Th3AgCVZFCmujDlGNvfuoDvDgeesiC5ZQyYZ_uxHNn7IcQolU1LbBDnSry7WaglbhL-DnbnIOq_pQGRhw5zS9yYKyWWrO31XrV-2MA797-FgpCU7N-mzPUC2nUMhHrYt9C0A-h8h7ZtAF4AYl5LS3gZ-SARVp_K5-dpHhPC03Cx5gEkoL7EGsFNiEvvJkRlR_iaAgfRV-FFPbzMzqaKFi3c8GtUruarrhyMBdC-gmrKrTD_gzD_mTUJWRMYfR7W5cLl97vLC40ipUv85IkNP2KVLWi5B-2Kg_Jyhw0yz3X5wwCodG9Mn4rz0J8G-eZvahTaGCoEj0H5Zgyclq4cyESPqnzOqot-kQmG9eYEu9uQ1XSZ8gCEwes1MPTEd6l6v2Hwhw7qL1aj1B3rw-uPb_4mBhwj8BzZ5WRkbVpv0WqQr257Ysi5Hra3QCSdU8W8-58Gt4qQPuBA_khwgL4SjZnuji79NIoy4jQyA05j2WW4QQm6umkS8p4IXY6JkoOEPc1t.uM4OAVUbmD3kICouxGEL8w"

},

{

"rel": "authentication_details",

"href": "/v1/authentications/bankid_se/4c5d6d5cb844160bc28325b1160ca6ca31324822ffd136266c447370d0656ff8"

}

]

}

}Please note that “auto_start_token”, “authentication_id” as well as redirect and authentication_details links presence is determined by selected authentication_type and authentication_method

Fetching details of the Signing Key

This endpoint URL has the following form:

GET /corporate/v2/keys/<key_id>This endpoint supports GET HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}Where the request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "BaK_iwmU8AmGqRNP",

"creation_date_time": "2021-03-26T07:03:26.1792553Z",

"http_code": 200

},

"response": {

"key_id": "6cee4b05-2cb3-4e52-96f4-8f5b2ed8839a",

"key": "eyJjdHkiOiJKV1QiLCJlbmMiOiJBMjU2R0NNIiwiYWxnIjoiZGlyIn0..vkw9ZtLcMgpRBNx6.0fK7gXTx2kE6uNR1lh2fQPgAEW6z0VnY7ZANbRvb_V4JeUZcfef0Bg_VWws_0WrqFQRZVEe9diTEYS70ILAYrzL-twc7dFwaijawx49vkVQtGbmWeLGW_N0IDTlc6LJaN-zJSbT_Sdk7OmnKCqYu_ieQExOt-LHXbkndjQlY1zRzASKRLnB4N2vZp3Y-l5iq2hReT_cUZoPylth7tNShAZQ0i1RFt0Vbahm8EofST4vN0UGuZVtGZczUq25GRuK70D9lLSDFUvQc5csjlAYC8JAhweMECZ9871y9GXYTui1TZFaTOj8F28rq5qlhBeYZLg_etVS9B9EYuwifEP4KSyaPAV1e1umANbqaBiRNBpVXM8GNWwhVt8x-_9FsyJ371CT9mXyb9dpmOFBHIvygNPXXSem5rWfcJZnK0lLncwo5nX0IMRxSgUmShJfoTITqTSctSDSdSBbousH-y5v24xvGK6dP7Gs1a8i1pPQ6XtdYn580Gssd4SifZMSVJXyS7VFdlKPhv3ufd3C95rR-xA8D_hGW_Qge_Q5cWS1Klqr3MlbSzY_LEX47PIwRRifhGvSWIi5Vb7m1cmKwAZv0zgB-WPJDSWyoPuYfbraPtzRpFh0gXvyGvL49t1Vse3SMkekC9UzewY02lhHQ1TyLcRhrfKdwJ6wMV5v7SIZxkb6A_S_RgY3crZQ3TB1A8BC_JJqZAMI2L7wTwFN2xPsvDrmVEmuhMYYe0sg51UVa9HcbKNSkc8au72ojNayiDvQ3DeHloGPNYX0OM02kbhxq_iS9ouKYOS6MaQV77b37ZGI72Y6Qrjg.01geJwmyl4IlsPeYLyvoOQ",

"roles": [

"SIGNING_PAYMENTS"

],

"status": "KEY_ACTIVE",

"expiration_date_time": "2021-06-24T07:02:58.2909218Z",

"_links": [

{

"rel": "self",

"href": "/v2/keys/6cee4b05-2cb3-4e52-96f4-8f5b2ed8839a"

},

{

"rel": "revoke",

"href": "/v2/keys/revoke"

}

]

}

}Revocation of access to Signing Key

This endpoint URL has the following form:

POST /corporate/v2/keys/revokeThis endpoint supports POST HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Digest: {digest}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}The body of the request :

{

"key": "eyJjdHkiOiJKV1QiLCJlbmMiOiJBMjU2R0NNIiwiYWxnIjoiZGlyIn0..vkw9ZtLcMgpRBNx6.0fK7gXTx2kE6uNR1lh2fQPgAEW6z0VnY7ZANbRvb_V4JeUZcfef0Bg_VWws_0WrqFQRZVEe9diTEYS70ILAYrzL-twc7dFwaijawx49vkVQtGbmWeLGW_N0IDTlc6LJaN-zJSbT_Sdk7OmnKCqYu_ieQExOt-LHXbkndjQlY1zRzASKRLnB4N2vZp3Y-l5iq2hReT_cUZoPylth7tNShAZQ0i1RFt0Vbahm8EofST4vN0UGuZVtGZczUq25GRuK70D9lLSDFUvQc5csjlAYC8JAhweMECZ9871y9GXYTui1TZFaTOj8F28rq5qlhBeYZLg_etVS9B9EYuwifEP4KSyaPAV1e1umANbqaBiRNBpVXM8GNWwhVt8x-_9FsyJ371CT9mXyb9dpmOFBHIvygNPXXSem5rWfcJZnK0lLncwo5nX0IMRxSgUmShJfoTITqTSctSDSdSBbousH-y5v24xvGK6dP7Gs1a8i1pPQ6XtdYn580Gssd4SifZMSVJXyS7VFdlKPhv3ufd3C95rR-xA8D_hGW_Qge_Q5cWS1Klqr3MlbSzY_LEX47PIwRRifhGvSWIi5Vb7m1cmKwAZv0zgB-WPJDSWyoPuYfbraPtzRpFh0gXvyGvL49t1Vse3SMkekC9UzewY02lhHQ1TyLcRhrfKdwJ6wMV5v7SIZxkb6A_S_RgY3crZQ3TB1A8BC_JJqZAMI2L7wTwFN2xPsvDrmVEmuhMYYe0sg51UVa9HcbKNSkc8au72ojNayiDvQ3DeHloGPNYX0OM02kbhxq_iS9ouKYOS6MaQV77b37ZGI72Y6Qrjg.01geJwmyl4IlsPeYLyvoOQ"

}Where the payment request is valid the response will be 201 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "jJvfipwBXY94SeI9",

"creation_date_time": "2021-03-26T07:04:07.0481972Z",

"http_code": 200

},

"response": {

"key_id": "6cee4b05-2cb3-4e52-96f4-8f5b2ed8839a",

"status": "KEY_REVOKED",

"_links": [

{

"rel": "self",

"href": "/v2/keys/revoke"

}

]

}

}Payment Initiation

This endpoint URL has the following form:

POST /corporate/premium/v2/paymentsThis endpoint supports POST HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Digest: {digest}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}

X-Nordea-Signing-Key: {key}SANDBOX ONLY

To make a payment in need of additional verification, please add: X-Response-Scenarios: paymentVerificationRequired

To test 3 different kinds of VoP-response codes, please add following values into X-Response-Scenarios attribute:

- verificationOfPayeeCloseMatch - When used, changes the payment status to ‘AUTHORIZATION_PARTIAL’ with payment_status_reason ‘info.payment.vop_confirmation_required’ and Verification of Payee status to CLOSE_MATCH.

- verificationOfPayeeNoMatch - When used, changes the payment status to ‘AUTHORIZATION_PARTIAL’ with payment_status_reason ‘info.payment.vop_confirmation_required’ and Verification of Payee status to NO_MATCH.

- verificationOfPayeeNotAvailable - When used, changes the payment status to ‘AUTHORIZATION_PARTIAL’ with payment_status_reason ‘info.payment.vop_confirmation_required’ and Verification of Payee status to NOT_AVAILABLE.

The body of the request :

{

"template_id": "SEPA_CREDIT_TRANSFER_FI",

"amount": 123.45,

"currency": "EUR",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

}

},

"external_id": "32rr98-fhff289-328f92-dd29",

"end_to_end_id": "2019-07-31 0001"

}Where the payment request is valid the response will be 201 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "2ZIa8JcmM8MQ9nRq",

"creation_date_time": "2021-03-26T07:06:31.3150027Z",

"http_code": 201

},

"response": {

"_id": "7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"external_id": "32rr98-fhff289-328f92-dd29",

"end_to_end_id": "2019-07-31 0001",

"amount": "123.45",

"requested_execution_date": "2021-03-26",

"currency": "EUR",

"urgency": "NORMAL",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

}

},

"create_timestamp": "2021-03-26T08:05:04.0345421",

"status_timestamp": "2021-03-26T08:06:31.3150027",

"payment_status": "PAYMENT_INITIATED",

"verification_of_payee_result": {

"status": "MATCH"

},

"_links": [

{

"rel": "self",

"href": "/premium/v2/payments"

},

{

"rel": "sign",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024/sign"

},

{

"rel": "details",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024"

}

]

}

}Fetching details of the Payment

This endpoint URL has the following form:

GET /corporate/premium/v2/payments/<payment_id>This endpoint supports GET HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}Where the request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "kG44iARowVH3mS5X",

"creation_date_time": "2021-03-26T07:07:08.0166465Z",

"http_code": 200

},

"response": {

"_id": "7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"external_id": "32rr98-fhff289-328f92-dd29",

"end_to_end_id": "2019-07-31 0001",

"amount": "123.45",

"requested_execution_date": "2021-03-26",

"execution_date": "2021-03-26",

"currency": "EUR",

"urgency": "NORMAL",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

},

"bank": {

"bic": "NDEAFIHH",

"country": "FI"

}

},

"create_timestamp": "2021-03-26T08:05:04.0345421",

"status_timestamp": "2021-03-26T08:07:08.0166465",

"payment_status": "PAYMENT_EXECUTED",

"verification_of_payee_result": {

"status": "MATCH"

},

"_links": [

{

"rel": "self",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024"

}

]

}

}And here under is another Sepa-payment initiation request. VoP-response is CLOSE_MATCH in this case and response include more VoP-information

{

"template_id": "SEPA_INSTANT_CREDIT_TRANSFER_FI",

"amount": "123.45",

"currency": "EUR",

"end_to_end_id": "13227asdfds",

"external_id": "{{randomUUID}}",

"requested_execution_date": "{{today}}",

"debtor": {

"account": {

"currency": "EUR",

"type": "IBAN",

"value": "FI4616603001014326"

},

"own_reference": "Own message"

},

"creditor": {

"account": {

"type": "IBAN",

"value": "FI1350001520000081"

},

"message": "Invoice 5071",

"name": "Screws and Nuts Ltd"

}

}And corresponding response:

{

"group_header": {

"message_identification": "7f62ba1ac81ed863",

"creation_date_time": "2025-04-10T06:28:34.324722717Z",

"http_code": 201

},

"response": {

"_id": "0dd50f26-36cf-4f9a-87bd-f214aa72d7b7",

"template_id": "SEPA_INSTANT_CREDIT_TRANSFER_FI",

"external_id": "c23b9b69-d023-4e52-b374-8e58d6c65194",

"end_to_end_id": "13227asdfds",

"amount": "123.45",

"requested_execution_date": "2025-04-10",

"currency": "EUR",

"urgency": "INSTANT",

"debtor": {

"account": {

"value": "FI4616603001014326",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own message"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Screws and Nuts Ltd",

"message": "Invoice 5071"

},

"status_timestamp": "2025-04-10T06:28:34.324732201",

"create_timestamp": "2025-04-10T06:28:34.316254105",

"payment_status": "PAYMENT_INITIATED",

"payment_status_reason": "info.payment.vop_confirmation_required",

"payment_status_reason_description": "Recipient name partially differs from the account holder name. Check the recipient information.",

"verification_of_payee_result": {

"status": "CLOSE_MATCH",

"matched_creditor_name": "Screws And Nuts Ltd"

},

"_links": [

{

"rel": "self",

"href": "/premium/v2/payments"

},

{

"rel": "sign",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7/sign"

},

{

"rel": "cancel",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7/cancel"

},

{

"rel": "details",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7"

}

]

}

}Fetching list of payments

This endpoint URL has the following form:

GET /corporate/premium/v2/paymentsThis endpoint supports GET HTTP method.

The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}The following optional query parameters are supported:

creation_from_timestamp: {creation_from_timestamp}

creation_to_timestamp: {creation_to_timestamp}

execution_from_date: {execution_from_date}

execution_to_date: {execution_to_date}

debtor_accounts: {debtor_accounts}

to_be_verified: {to_be_verified}

min_amount: {min_amount}

max_amount: {max_amount}

payment_status: {payment_status}

created_by: {created_by}

external_ids: {external Ids}

page: {page}

size: {size}Where the request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "kG44iARowVH3mS5X",

"creation_date_time": "2021-03-26T07:07:08.0166465Z",

"http_code": 200

},

"response": {

"payments": [

{

"_id": "7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"external_id": "32rr98-fhff289-328f92-dd29",

"end_to_end_id": "2019-07-31 0001",

"amount": "123.45",

"requested_execution_date": "2021-03-26",

"execution_date": "2021-03-26",

"currency": "EUR",

"urgency": "NORMAL",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

},

"bank": {

"bic": "NDEAFIHH",

"country": "FI"

}

},

"create_timestamp": "2021-03-26T08:05:04.0345421",

"status_timestamp": "2021-03-26T08:07:08.0166465",

"payment_status": "PAYMENT_EXECUTED",

"verification_of_payee_result": {

"status": "MATCH"

},

"_links": [

{

"rel": "details",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024"

}

]

},

{

"_id": "f59abbab-8df4-49be-b7fe-247f279b5aab",

"external_id": "0093c3d3-ea30-4288-a7be-6c43c5533241",

"end_to_end_id": "2019-07-31 0002",

"amount": "123.45",

"requested_execution_date": "2021-03-28",

"execution_date": "2021-03-28",

"currency": "EUR",

"urgency": "NORMAL",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

},

"bank": {

"bic": "NDEAFIHH",

"country": "FI"

}

},

"create_timestamp": "2021-03-26T08:13:06.0134652",

"status_timestamp": "2021-03-26T08:15:02.0234312",

"payment_status": "PAYMENT_ACCEPTED",

"verification_of_payee_result": {

"status": "MATCH"

},

"_links": [

{

"rel": "details",

"href": "/premium/v2/payments/f59abbab-8df4-49be-b7fe-247f279b5aab"

},

{

"rel": "cancel",

"href": "/premium/v2/payments/f59abbab-8df4-49be-b7fe-247f279b5aab/cancel"

}

]

}

],

"additional_data": {

"total_number_of_payments": 2

},

"_links": [

{

"rel": "first",

"href": "/premium/v2/payments?page=1&size=20"

},

{

"rel": "self",

"href": "/premium/v2/payments?page=1&size=20"

},

{

"rel": "last",

"href": "/premium/v2/payments?page=1&size=20"

}

]

}

}Signing a Payment

This endpoint URL has the following form:

PATCH /corporate/premium/v2/payments/<payment_id>/signThis endpoint supports PATCH HTTP method and does not require DIGEST header. The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}

X-Nordea-Signing-Key: {key}

payment_id: {payment Id}Where the payment request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "ff8e043036d9219a",

"creation_date_time": "2025-04-10T06:34:47.14846555Z",

"http_code": 200

},

"response": {

"_id": "0dd50f26-36cf-4f9a-87bd-f214aa72d7b7",

"template_id": "SEPA_INSTANT_CREDIT_TRANSFER_FI",

"external_id": "c23b9b69-d023-4e52-b374-8e58d6c65194",

"end_to_end_id": "13227asdfds",

"amount": "123.45",

"requested_execution_date": "2025-04-10",

"execution_date": "2025-04-10",

"currency": "EUR",

"urgency": "INSTANT",

"debtor": {

"account": {

"value": "FI4616603001014326",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own message"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Screws and Nuts Ltd",

"message": "Invoice 5071",

"bank": {

"bic": "NDEAFIHH",

"country": "FI"

}

},

"status_timestamp": "2025-04-10T06:34:47.148474904",

"create_timestamp": "2025-04-10T06:28:34.316254105",

"payment_status": "AUTHORIZATION_PENDING",

"verification_of_payee_result": {

"status": "CLOSE_MATCH",

"matched_creditor_name": "Screws And Nuts Ltd"

},

"_links": [

{

"rel": "self",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7/sign"

},

{

"rel": "cancel",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7/cancel"

},

{

"rel": "details",

"href": "/premium/v2/payments/0dd50f26-36cf-4f9a-87bd-f214aa72d7b7"

}

]

}

}Verify a Payment

This endpoint URL has the following form:

POST /corporate/premium/v2/payments/<payment_id>/verifyThis endpoint supports POST HTTP method. The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

Digest: {digest}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}

payment_id: {payment Id}SANDBOX ONLY

When using REDIRECT authentication_type please add: X-Nordea-Mock-Authorizer-Id: {authorizer_id}

The body of the request will vary, determined by the authentication type chosen.

Example of DECOUPLED authentication type with MTA authentication method

{

"authentication_type": "DECOUPLED",

"authentication_method": "MTA",

"authorizer_id": "70311198"

}Example of DECOUPLED authentication type with BANKID_SE authentication method

{

"authentication_type": "DECOUPLED",

"authentication_method": "BANKID_SE"

}Example of REDIRECT authentication type

{

"authentication_type": "REDIRECT",

"redirect_uri": "https://test.com",

"state": "state",

"authentication_method": "BANKID_SE",

"language": "en"

}Where the payment request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "C7EergJlO1k2Ru7O",

"creation_date_time": "2021-03-26T07:11:43.569898Z",

"http_code": 200

},

"response": {

"_id": "7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"external_id": "32rr98-fhff289-328f92-dd2923",

"end_to_end_id": "2019-07-31 0001",

"amount": "123.45",

"requested_execution_date": "2021-03-26",

"execution_date": "2021-03-26",

"currency": "EUR",

"urgency": "NORMAL",

"debtor": {

"account": {

"value": "FI4715723000311878",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

},

"bank": {

"bic": "NDEAFIHH",

"country": "FI"

}

},

"create_timestamp": "2021-03-26T08:05:04.0345421",

"status_timestamp": "2021-03-26T08:11:43.569898",

"payment_status": "AUTHORIZATION_PENDING",

"auto_start_token": "8441d326-2d6e-4e4f-9412-303ec3d0931c",

"authentication_id": "4c5d6d5cb844160bc28325b1160ca6ca31324822ffd136266c447370d0656ff8",

"verification_of_payee_result": {

"status": "MATCH"

},

"_links": [

{

"rel": "self",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024/verify"

},

{

"rel": "details",

"href": "/premium/v2/payments/7f156cea-0ebb-4c7e-ab55-96ea9fc3b024"

},

{

"rel": "redirect",

"href": "https://api.nordeaopenbanking.com/corporate/payments/identify?client_id=Psf34PDHxdLy2Sfyr4UF&code_challenge_method=S256&redirect_uri=https%3A%2F%2Fapi.nordeaopenbanking.com%2Fcorporate%2Fpayments%2Foauth&response_type=code&code_challenge=HAULnO8Z7njZCem7zHPq0FzSQxW5Sc2Im2WWEsVwlEU&scope=openid+agreement&state=80dff5c3-a1f9-499a-8bad-bf886801e0b9&nonce=PhSHQiuWOwCbRTGS9N5SrlRA2kSDyjK3DUGw71ly&login_hint=bankid_se&signing_token=eyJjdHkiOiJKV1QiLCJlbmMiOiJBMjU2R0NNIiwiYWxnIjoiUlNBLU9BRVAtMjU2In0.hMT3ZHEcf3TNpnCrYfiisvB08y9C0AtezO9QuGqtR0L0OeLt8HWYN0v3PU8ZF1iu_v_Rh5LA4CjoIOU8lCGLSFmddUEfhl9iqMUeSh5wLizZv4pF6bo_YRnmR9WqLMzZpq_-dB9MB7mMA2KVHX6Jmy3ZWrleFuUabGdgypdyKy1Bi9tFAYFE0tHEAwm_8vPVyppypT6VFaldvRO8kTJrqZVuTFIYLXDKV69D8b40mEkcTRC5CO029UgCyyV8-Ia3vdhjk_0QklszkrAU0KlvIzVYat4GbXzbTC-snHJ_qgutFygtNH2vM1a84rLaYszbRa6dT285WsyCuNjMIHwSnQ.Dn2xpMne03d9EKzd.Sy83KdbkCzsXaSrUASZdWyRGKZ61jErjQLhN31j6ty7R7z81DGcdWUrB9X4DnHmWq2ZbzE2QI7xc3lAAllClrDyB90ZRPK62yLDprU0CHvIGIuLtC-ORqI5NhNtVS1XWkgHT_Th3AgCVZFCmujDlGNvfuoDvDgeesiC5ZQyYZ_uxHNn7IcQolU1LbBDnSry7WaglbhL-DnbnIOq_pQGRhw5zS9yYKyWWrO31XrV-2MA797-FgpCU7N-mzPUC2nUMhHrYt9C0A-h8h7ZtAF4AYl5LS3gZ-SARVp_K5-dpHhPC03Cx5gEkoL7EGsFNiEvvJkRlR_iaAgfRV-FFPbzMzqaKFi3c8GtUruarrhyMBdC-gmrKrTD_gzD_mTUJWRMYfR7W5cLl97vLC40ipUv85IkNP2KVLWi5B-2Kg_Jyhw0yz3X5wwCodG9Mn4rz0J8G-eZvahTaGCoEj0H5Zgyclq4cyESPqnzOqot-kQmG9eYEu9uQ1XSZ8gCEwes1MPTEd6l6v2Hwhw7qL1aj1B3rw-uPb_4mBhwj8BzZ5WRkbVpv0WqQr257Ysi5Hra3QCSdU8W8-58Gt4qQPuBA_khwgL4SjZnuji79NIoy4jQyA05j2WW4QQm6umkS8p4IXY6JkoOEPc1t.uM4OAVUbmD3kICouxGEL8w"

},

{

"rel": "authentication_details",

"href": "/v1/authentications/bankid_se/4c5d6d5cb844160bc28325b1160ca6ca31324822ffd136266c447370d0656ff8"

}

]

}

}Please note that “auto_start_token”, “authentication_id” as well as redirect and “authentication_details” links presence is determined by selected “authentication_type” and “authentication_method”

Signing multiple payments

This endpoint URL has the following form:

POST/corporate/premium/v2/payments/signThis endpoint supports PATCH HTTP method and does not require DIGEST header. The following headers must be used:

Authorization: Bearer {access_token}

Signature: {signature}

X-IBM-Client-Id: {client_id}

X-IBM-Client-Secret: {client_secret}

X-Nordea-Originating-Date: {date}

X-Nordea-Originating-Host: {host}

X-Nordea-Signing-Key: {key}The body of the request :

{

"payment_id_list": [

"7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"f59abbab-8df4-49be-b7fe-247f279b5aab"

]

}Where the payment request is valid the response will be 200 SUCCESS and formatted like the example below

{

"group_header": {

"message_identification": "F64MEP2Jl1LsTukB",

"creation_date_time": "2021-09-13T08:58:23.0951993Z",

"http_code": 200

},

"response": {

"payments": [

{

"_id": "7f156cea-0ebb-4c7e-ab55-96ea9fc3b024",

"amount": "123.45",

"currency": "EUR",

"requested_execution_date": "2019-07-31",

"execution_date": "2021-08-01",

"debtor": {

"account": {

"value": "FI4116603500005114",

"type": "IBAN",

"currency": "EUR"

},

"own_reference": "Own notes"

},

"creditor": {

"account": {

"value": "FI1350001520000081",

"type": "IBAN"

},

"name": "Finnish Supplier Inc",

"reference": {

"value": "RF18539007547034",

"type": "RF"

}

},

"external_id": "32rr98-fhff289-328f92-dd29",

"end_to_end_id": "2019-07-31 0001",

"status_timestamp": "2021-09-13T08:58:23.0951993",

"create_timestamp": "2021-09-13T08:57:50.3416179",

"payment_status": "AUTHORIZATION_PENDING",